Landlords that take this mortgage deductibility should be charged capital gains tax when they sell their property then.The fact is that most landlords with mortgages will already be topping up the mortgage payments each month as the rent doesn't cover all the expenses.

Say a landlord charges $600 PW so is receiving $31,200 PA in rent for a property that's worth $700,000.

If they still owe $450,000 on a mortgage of $600,000 on the property at 7%, that's costing them $42,536 PA just in mortgage payments.

Add to that, insurance ($1,800 PA), repairs and maintenace (1% of the value of the property is $7,000 PA), rates ($2,800 PA) and bulk water charges ($480 PA).

That means that the combined outgoings for the property is just under $55,000 PA meaning the landlord has to top up the property by just under $24,000 PA or $2,400 per month or $462 per week.

But, ATM, the landlord can only claim back 50% of the interest so, even though he's paying $24,000 PA to top up the property, he still has to pay an additional $1,100 in tax.

Even with the change to being able to claim back all the interest, in the example above, he's still having to top up the property by over $19,000.

There isn't the financial space to reduce the rent but, because he's expenses has reduced, it does mean that future rental increases won't be as large.

View attachment 6170

And that's not taking into account that interest rates are dropping. If, in two years when the interest mortgage deductibility gets back to 100% but the interest rates have dropped to 5%, the landlords expenses go down, so the landlord has gone from spending a projected $19,330 PA to top up the rental properties accounts to spending over $22,500 PA to top it up.

View attachment 6172

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Politics NZ Politics

- Thread starter wizard of Tauranga

- Start date

Yep.Landlords that take this mortgage deductibility should be charged capital gains tax when they sell their property then.

Careful what you wish for.Landlords that take this mortgage deductibility should be charged capital gains tax when they sell their property then.

As previously mentioned most landlords have to subsidise their houses, the rent falls well short of covering costs. Therefore capital growth over the medium term is the only attraction to owning a rental property.

The money used to subsidise the house is money that tax has been paid on.

Squeezing landlords will only lead to increased rents as they depart this investment.

not all, but most landlords don’t sell anyway. the goal is to have the rent as income in older age since the pension isn’t enough to live off.Landlords that take this mortgage deductibility should be charged capital gains tax when they sell their property then.

Also, i still for the life of me don’t see why it should be any different to any other business claiming back interest on loans.

it is a business after all.

Do the statistics actually back that up though? Since 2001 to 2022, wages have increased by an average of 3.7% each year but only in three years has the increase in wages been within 0.5% of the increase in rent. And population (indicating the potential supply levels) has only in three years been within 1% of the increase in rents.That might be the case for you, but the long term trend is wages and supply (which is really tied to immigration). Landlords will take the maximum rent they can.

Over that time, the median wage and salary has increased by 3.7% PA and the population has increased 1.7% PA but rents have increased by 4.9% PA.

And to show how immigration is even worse, in 2021, there was a net immigration loss of 6,580 people, rents went up 10%!!!

Data is taken from the following sites:

Weekly earnings rise as more in full-time employment | Stats NZ

Median weekly earnings from wages and salaries rose by 8.8 percent to $1,189 in the year to the June 2022 quarter.

Population | Stats NZ

Find out the number of people in New Zealand and in different areas of New Zealand. These areas include regions, cities and towns, local board areas, and area units.

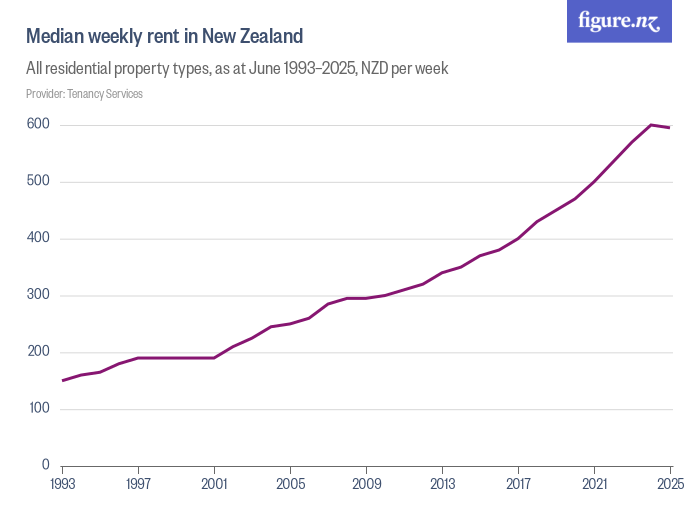

Median weekly rent in New Zealand

All residential property types, as at December 1993–2023, NZD per week

Return to net migration gains in 2022 | Stats NZ

There was a provisional net migration gain of 15,800 in 2022.

Winston Peters stirs up overseas media, questions India's connection to high-profile killing

Canadian PM Trudeau previously accused Hardeep Singh Nijjar's killers of being Indian agents.

Heard winston in the last couple of days talking about going to India with the intention of closer ties. This doesn’t seem like the smartest ploy

A speculator who doesn't rent a property out can still claim interest deductibility as an expense but, because their business is flipping houses, they have to pay tax on the gain in the value of the property.Does interest deductibility put speculators in a better or worse position?

So a speculator buys a property for $800,000. They spend $100,000 on the property in improvements and interest. They then sell it six months later for $1,000,000 so they'll pay tax on the $100,000 profit (the sale price less the purchase price less their expenses including interest).

Alternatively, an investor who purchases a property, rents it out and then sells it within two years can't deduct the interest and would also have to pay tax on the capital gain because of the Brightline test (under Labour, the property had to be held for ten years to not be subject to the Brightline test while the new government is moving it back to two years). My personal opinion, two years is too short and the test should be at five years.

Which was the purpose of the Brightline test.... to ensure that people who sold a house within a certain period, paid tax on the capital gain. As I said in another post, I think both the previous government (10 years) and the current government (2 years) have gotten the period wrong and I personally like the idea of it being set at five years.Landlords that take this mortgage deductibility should be charged capital gains tax when they sell their property then.

Rizzah

Contributor

Do the statistics actually back that up though? Since 2001 to 2022, wages have increased by an average of 3.7% each year but only in three years has the increase in wages been within 0.5% of the increase in rent. And population (indicating the potential supply levels) has only in three years been within 1% of the increase in rents.

Over that time, the median wage and salary has increased by 3.7% PA and the population has increased 1.7% PA but rents have increased by 4.9% PA.

And to show how immigration is even worse, in 2021, there was a net immigration loss of 6,580 people, rents went up 10%!!!

View attachment 6181

Data is taken from the following sites:

Weekly earnings rise as more in full-time employment | Stats NZ

Median weekly earnings from wages and salaries rose by 8.8 percent to $1,189 in the year to the June 2022 quarter.www.stats.govt.nz

Population | Stats NZ

Find out the number of people in New Zealand and in different areas of New Zealand. These areas include regions, cities and towns, local board areas, and area units.www.stats.govt.nz

Median weekly rent in New Zealand

All residential property types, as at December 1993–2023, NZD per weekfigure.nz

Return to net migration gains in 2022 | Stats NZ

There was a provisional net migration gain of 15,800 in 2022.www.stats.govt.nz

Your numbers back up exactly the reports conclusion.

Rent tracks wages and housing supply. Here's a nice wee graph.

Report.

Last edited:

Rizzah

Contributor

It should be different, people live in the houses. Housing costs impact the wider economy. Voters and decision makers strangle supply in their own interests, because the status quo is good for them and their capital gains.not all, but most landlords don’t sell anyway. the goal is to have the rent as income in older age since the pension isn’t enough to live off.

Also, i still for the life of me don’t see why it should be any different to any other business claiming back interest on loans.

it is a business after all.

We need to shift from viewing our homes as a main source of retirement savings. Focusing on housing price growth for personal gain pollutes the well.

If we are concerned about retirement savings, Boost compulsory super (Kiwisaver isn't compulsory currently), ratchet up the mandatory minimum contribution for Kiwisaver over X many years ala Australia.

Giant super funds would also help with infrastructure investment, as we would have a fund/funds available to purchase Govt bonds. Govt borrowing/bonds are the cheapest way to fund infrastructure.

Except, that's based on the average hourly earnings and not the median salary and wages. Also, the median rent over that period they've shown has gone up over 100%, not the 83% they've used.Your numbers back up exactly the reports conclusion.

Rent tracks wages and housing supply. Here's a nice wee graph.

View attachment 6183

TBH, they've used one data set to try and prove a point, I've used another data set that disproves it.

Like the old saying says... "There are lies, damn lies and statistics".

Rizzah

Contributor

it's not JUST wages though..... SUPPLY also impacts rent.Except, that's based on the average hourly earnings and not the median salary and wages. Also, the median rent over that period they've shown has gone up over 100%, not the 83% they've used.

TBH, they've used one data set to try and prove a point, I've used another data set that disproves it.

Like the old saying says... "There are lies, damn lies and statistics".

Tragic

Contributor

I use a property manager, they get the maximum the market will bear while keeping occupation high.That might be the case for you, but the long term trend is wages and supply (which is really tied to immigration). Landlords will take the maximum rent they can.

They don't consider how much I can claim back on interest and wouldn't know or care how much I have borrowed.

I belong to a FB group for landlords (I've actually used a lot of the arguments you andit's not JUST wages though..... SUPPLY also impacts rent.

One of the reasons I don't think annual wage increases should be considered is that NO landlord should know firstly how much the tenant/s earns and secondly how much their wages/salary has increased over the year. I'd consider the CPI increase and the increase in the expenses I had before trying to work out the income of the tenant.... but that's just me.

what about restaurants? people neIt should be different, people live in the houses. Housing costs impact the wider economy. Voters and decision makers strangle supply in their own interests, because the status quo is good for them and their capital gains.

We need to shift from viewing our homes as a main source of retirement savings. Focusing on housing price growth for personal gain pollutes the well.

If we are concerned about retirement savings, Boost compulsory super (Kiwisaver isn't compulsory currently), ratchet up the mandatory minimum contribution for Kiwisaver over X many years ala Australia.

Giant super funds would also help with infrastructure investment, as we would have a fund/funds available to purchase Govt bonds. Govt borrowing/bonds are the cheapest way to fund infrastructure.

ed to eat as they need to live in houses right?

what if you bought a run down restaurant, took out a huge loan, renovated, upskilled staff, and made it successful, you should have to pay a capital gains tax as well as not be able to claim back the interest on the loan for the investment?

i understand and agree with the second half of your post there. i just don’t see how it think it’ll happen any time soon.

until any government can build enough houses to take the wind out of landlords sails, nothing will change. everyone needs somewhere to live and if the state can’t supply it, then someone has to right?

also, im sure a lot of people don’t want the responsibility of owning a house. the upkeep, rates, insurance, repairs etc.

also how is the average person on the average wage supposed to save $100-200k for a deposit?

nothing will change the way things are, not any time soon i don’t think

Rizzah

Contributor

Not a great comparison. Everyone doesn't need to go to a restaurant to survive.what about restaurants? people ne

ed to eat as they need to live in houses right?

what if you bought a run down restaurant, took out a huge loan, renovated, upskilled staff, and made it successful, you should have to pay a capital gains tax as well as not be able to claim back the interest on the loan for the investment?

i understand and agree with the second half of your post there. i just don’t see how it think it’ll happen any time soon.

until any government can build enough houses to take the wind out of landlords sails, nothing will change. everyone needs somewhere to live and if the state can’t supply it, then someone has to right?

also, im sure a lot of people don’t want the responsibility of owning a house. the upkeep, rates, insurance, repairs etc.

also how is the average person on the average wage supposed to save $100-200k for a deposit?

nothing will change the way things are, not any time soon i don’t think

You can't leave a restaurant empty and it will increase in value.

no you’re right, but it’s still providing a service and is still a business.Not a great comparison. Everyone doesn't need to go to a restaurant to survive.

You can't leave a restaurant empty and it will increase in value.

Rizzah

Contributor

Lol, but there are other people/orgs in the market that know the numbers, and will work out the limit of rent that can be extracted. Most landlords will then follow the market trend.I belong to a FB group for landlords (I've actually used a lot of the arguments you andjuju have raised on here against some of them on there who I wonder if they're more slumlords than landlords.... believe it or not, I'm considered one of the more moderate ones on there) and they're had discussions on what criteria they use to decide on their rental increases. I can't remember any of them saying that they would use wages and supply increases to determine the changes in rent.

One of the reasons I don't think annual wage increases should be considered is that NO landlord should know firstly how much the tenant/s earns and secondly how much their wages/salary has increased over the year. I'd consider the CPI increase and the increase in the expenses I had before trying to work out the income of the tenant.... but that's just me.

The Govt even has a market rent tool on the tenancy services website.

One of the most accurate places to get an idea of rent is Trade Me and homes.co.nz. They base their rental appraisals on what is advertised for rent in an area and then compare that to the house you’re looking at. I prefer that than appraisals from property managers as they will always push for the highest return for themselves through their management fees.Lol, but there are other people/orgs in the market that know the numbers, and will work out the limit of rent that can be extracted. Most landlords will then follow the market trend.

The Govt even has a market rent tool on the tenancy services website.

I wonder if a way to make property investment less attractive would be to modify the new DTI ratios when they come in and instead of a perspective landlord being able to borrow on 100% of their income from both their job and the estimated rental income but have the maximum amount they can borrow based on their entire salary and only half the rental income. Another thing could be to make it that landlords can’t just borrow 100% for a rental property using the existing equity in their family home but are required to have an actual deposit of 15 to 20% which has to be used for the purchase and not be an offset amount to reduce interest.

Last edited: